Ever since President Lyndon Johnson launched a set of domestic programs aimed at ending poverty and racial injustice, as a nation we have tried to reduce (if not eliminate) poverty, homelessness, and disenfranchisement. Those domestic programs range from the Food Stamp Act of 1964, the Social Security Amendments of 1965 (which created Medicare and Medicaid), and the Elementary and Secondary Education Act of 1965 and Head Start, to the Civil Rights Act of 1964 and the Voting Rights Act of 1965. These programs made up much of Johnson’s War on Poverty and his Great Society vision for the U.S.’s future. These laudatory acts were and are essential to our democracy and overall prosperity as a nation committed to equity and social justice.

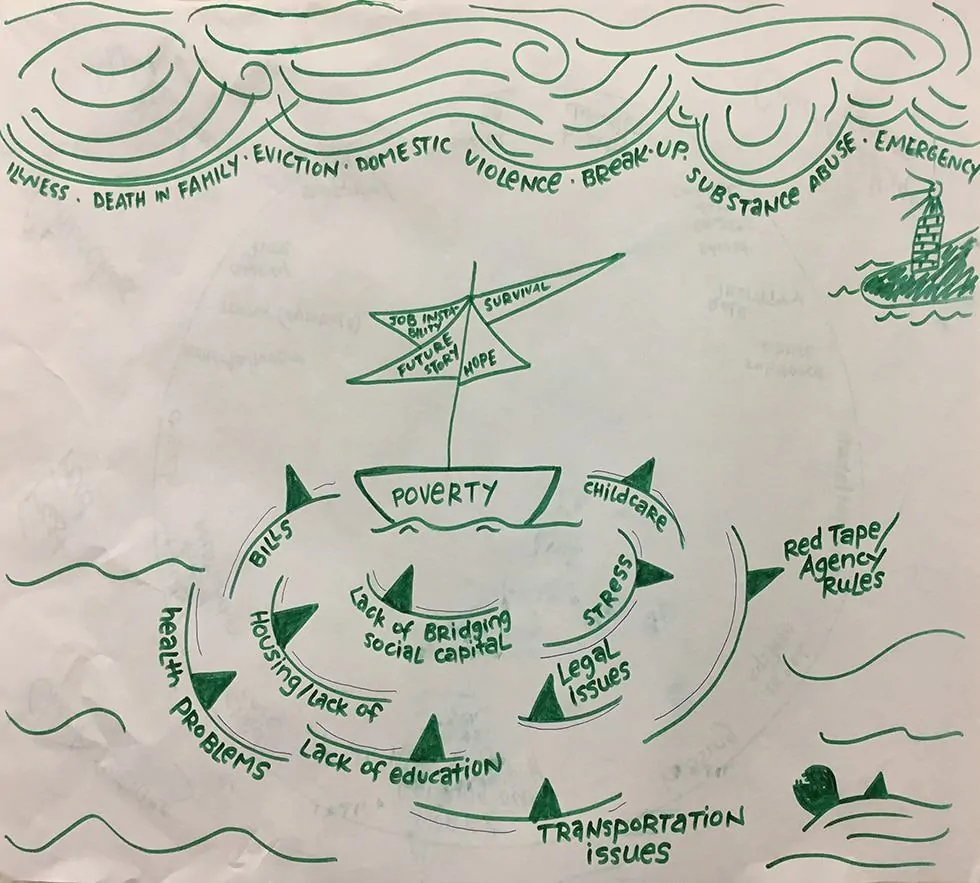

However, hidden within these programs were regulations creating consequences and barriers that prevent many people from finding a bridge out of poverty. Here is the negative impact of the “benefits cliff effect.”

What is the benefits cliff effect?

A benefits cliff is what happens when public benefit programs taper off or phase out quickly when household earnings increase. The abrupt reduction or loss of benefits can be very disruptive for families because even though household earnings increased, they usually have not increased enough for self-sufficiency. For self-sufficiency, we must help families build assets. The Atlanta Women’s Foundation describes self-sufficiency this way:

- “As Asset Funders Network explains, “Without assets, people just make ends meet, living paycheck to paycheck. With assets, people can:

- Remain stable through financial emergencies.

- Stay in their homes and neighborhoods.

- Use their good credit to secure a mortgage.

- Pursue higher education for themselves or their children.

- Take risks that result in a better job or starting a business.

- Save for retirement.”

- Asset building allows an individual or family to develop stability and not live in crisis mode or on the verge of crisis mode.2

The cliff effect happens to workers near the poverty line who are eligible for a variety of programs (e.g., food stamps, Medicaid, the Earned Income Tax Credit (EITC), Temporary Assistance to Needy Families (TANF), and subsidized public housing). The working poor reach a point where a one-dollar increase in their hourly wage can result in a significant reduction in benefits. The outcome is the added dollars will not make up for the loss of food stamps, childcare, or other benefits designed to help people in poverty or near poverty.

The steep reduction in benefits can discourage people from engaging in workforce development programs or from even seeking employment in the first place. Many people in poverty rely on a combination of earned income, public benefits, and community supports to survive. When these resources are unpredictable, people in poverty inevitably must choose which necessities they will not buy. Inconsistent access to nutritious food, medical care, safe housing, and childcare has detrimental effects on health and well-being.

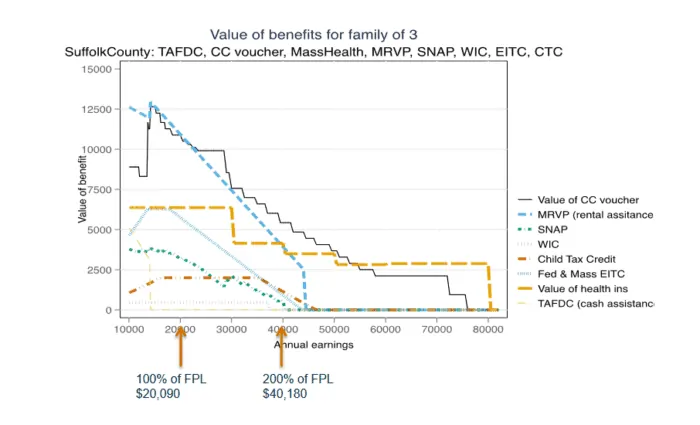

Here is an example of the benefits cliff from the Center for Social Policy, University of Massachusetts, Boston. This graph shows a situation where a higher income actually means fewer resources overall:

For even more on cliff effects, visit the Center for Social Policy’s website.

The chart above illustrates the dilemma of the benefits cliff. Raising the minimum wage to $15 an hour ($30,000 per year) wouldn’t necessarily solve the problem. The regulations and the administration of public benefits are where the problem lies.

Yes, we must work to increase minimum wages and advocate for salaries that allow families to thrive, not just survive. But just as important as helping these families become self-sufficient is finding ways to mitigate, or better yet end, the negative impact of the benefits cliff. Strategically increasing wages must happen if we are to reinforce and sustain the effectiveness of our poverty reduction initiatives.

What can States do about the benefits cliff?

We must consider the gradual reduction of benefits as salaries increase, turning the precipitous cliffs into gentle slopes, which would allow families to become self-sufficient over time. North Carolina has taken steps to lessen the severity of the cliff effect. North Carolina has chosen to explore and mitigate eligibility choices with the Temporary Assistance to Needy Families (TANF) program include addressing asset policies and how state policies treat child support income when deciding eligibility.

- For instance, according to a summary by National Conference of State Legislatures, circa October 2011.

- When calculating income not counting a family’s assets or vehicles owned by families applying for benefits.

- North Carolina when deciding Child Care Development Fund (CCDF) subsidies it has set the income level at 200% the Federal Poverty level

- North Carolina’s “Earned Income Tax Credit” policies refund state level income tax

However, in a recent article by Karen Weese, Slate group publication, “Beware the Child Care Cliff” she wrote: “It’s great to ease people out gradually, but there are people who are facing a closed door to begin with,” she says. Indeed, one of the most shocking statistics about child care in the United States is this: Only 1 in 6 children eligible for child care assistance ever get it at all. Think about that: On a playground filled with 100 kids whose families need and qualify for child care assistance, only 16 of them will get it. Last year, the state of Texas had a stunning 41,593 children on its waiting list for child care assistance; North Carolina had 26,608; Massachusetts had 24,202. The state of Georgia froze its waiting list entirely, simply turning away families without taking their names.” Thus, like many states across the nation, more work needs to be done in North Carolina to help people gradually ease from poverty and dependency on governmental benefits to self-sufficiency and economic upward mobility3.

If we are to end generational poverty, we must encourage more states to adopt a two-generation approach (2Gen) that focuses on forging opportunities to address the needs of both parents and their children4. Charlotte Family Housing (CFH), is a nonprofit focused on a “shelter-to-housing” program for homeless single parent households. Its two-generational approach is one of the strategies employed to empower families to achieve long-term self-sufficiency through shelter, housing, supportive services, and advocacy. CFH also uses youth enrichment programs that build academic and life skills. The program gives children the tools needed to create a cycle of generational success.5 In CFH’s 2Gen approach, it incorporates early learning and educational support into its programming. CFH ‘s clinical family social workers assist families and ensures their children ages 4 and 5 years old are aware of the Head-Start programming. CHF links families to early educational opportunities so their preschoolers can launch their way into an educational journey leading adult success. The research is clear; early learning opportunities is a key predictor of long-term success of children as they become adults.

Childcare is critical factor essential to the financial stability and success of a family. Many families in Charlotte face tough decisions because of the prohibitive cost of childcare affecting their ability to work and keep adequate housing. Charlotte Family Housing partners with Child Care Resources (CCRI) to provide families with access to safe, affordable, and quality childcare through subsidized vouchers.

The most precise definition of self-sufficiency is the income level a family needs to meet their basic needs without public assistance. Many states are seeking ways to enhance and accelerate self-sufficiency by addressing the negative impact of the benefits cliff. These states have created self-sufficiency calculators that alert social services staff and their customers when income thresholds could cause an abrupt reduction in services. These states have also set the income thresholds where self-sufficiency begins. The United Way of North Carolina’s self-sufficiency calculator determined this result for a two-parent family with an infant child and toddler:

- “Your family lives in Mecklenburg County, NC, with 2 adults and 2 children in your household. Our latest research indicates that your family needs an annual family income of $70,169 to make ends meet.”6

Other states have set up or changed programs and regulations to reduce the negative impact of the cliff effect related to TANF:

- Increasing the threshold on assets tests or completely ending the assets test so families can open savings accounts. Alabama, Maryland, Ohio, and Virginia are four states that have completely done away with assets tests.

- Arizona and six other states do not count child support benefits when determining which families are entitled to TANF.

- New York allows one automobile up to $12,000 fair market value. Furthermore, in the case of automobiles equipped for individuals with a disability, the equipment is not considered to increase the value of the vehicle.

These essential incremental steps are not enough; we need to do more to create a bridge out of poverty. The following remedies are steps in the right direction:

- Align eligibility determination procedures, documentation requirements, and timelines across programs so that people do not lose all their benefits at once.

- Gradually decrease benefits over a period of at least one year.

- Establish reasonable time frames for reporting changes in income and adjust regulations that will treat income from distinct types of employment differently in the benefit-determination calculations. For example, assessing overtime and temporary jobs individually so as not to penalize people unfairly.

- Provide warnings, and conduct benefit-adjustment hearings before sanctioning a recipient for potential noncompliance with program requirements.

- Fund “benefits transition navigators” who will help individuals find and access all the public benefits and community-based supports available to them. In addition to case management, information, and referral services, the navigators can help people understand options and consequences when balancing benefits, income, and community or social network supports.

- Conduct research on the effectiveness of coordination, as well as other “cliff effect interventions,” to provide quantitative evidence about cost efficiencies for programs and improved services and outcomes for individuals.

- Support the creation of a cross-agency “benefit coordination blueprint.” This blueprint would help train program staff at the local level. It could also guide investments in technology and infrastructure to connect, as appropriate, data and information systems.

What can employers do about the benefits cliff?

Employers can help reduce the benefits cliff by educating themselves on the trade-off between employment and benefits, then create solutions for barriers to getting and keeping jobs. Concerned employers might consider the following:

- Dealing with social services agencies takes up a lot of time. Employers can work to accommodate time off or adjust schedules for employees to attend benefits hearings and otherwise troubleshoot coordination of government benefits.

- Network with other employers to help workers access childcare and other social supports.

- Bring Success Coaches from the Employer Resource Network on site to aid employees with wraparound services on an ongoing basis.

What can community and faith-based organizations do about the benefits cliff?

Community-based and faith-based organizations are often the first line of defense and are increasingly the informal safety net for persons suffering economic hardships. While regularly overburdened with providing services, these entities can help address the cliff effect in the following ways:

- Supplement “benefit transition navigators” with a mobile “211” service that goes into neighborhoods to improve the availability of exact information about services and supports.

- Educate workforce development programs and employers about the barriers low-wage workers confront when taking part in education and training and about the trade-offs between meeting immediate needs and seeking socioeconomic advancement through employment.

- Facilitate collaboration across programs that serve low-wage workers.

- Support the continuation of task forces made up of members from public and private sectors, as well as state and local government agencies. The task forces should examine the range of issues affecting working persons in poverty, develop strategies to help them, and monitor the outcomes.

- Charlotte-Mecklenburg Opportunity Task Force is an excellent example. They wrote an in-depth analysis on the issues of economic mobility and formed “Leading on Opportunity organization, which is tasked with implementing the recommendation contained in their report.7

Charlotte Family Housing has collaborated closely with regional faith-based organizations, for which we are deeply grateful.8 These partnerships involve several programs:

- Hope Teams – A Hope Team is a group of 3-6 volunteers who partner with a family to provide love, support, and encouragement. Hope Teams build relationships with families under the guidance of our social workers and the Hope Team manager once the family has settled into their new home. A Hope Team helps empower a family to reach their goals by offering friendship and positive support network. Some of our Hope Teams have come from Christ Episcopal Church, Covenant Presbyterian, Forest Hill Church, Myers Park Presbyterian, Myers Park United Methodist, Sardis Presbyterian, St. Johns Baptist Church, St. John’s Baptist Church, St. John’s Episcopal Church, Renovatus, and Temple Beth El.

- Jubilee Christmas Store –The Jubilee Store offers families of Charlotte Family Housing an empowering, hopeful, dignified way of purchasing holiday gifts for their families. Through the opportunity provided by the Jubilee Store, families can actively engage in budgeting for, selecting, and buying gifts for their family members. On average, nearly 100 families shop and purchase new donated gifts at 30% of the retail price. More than 150 volunteers come together to make the store a smooth success by leading toy and gift donation outreach efforts, hosting day of children’s activities so that moms and dads can shop, welcoming volunteers, assisting shoppers, serving food, gift wrapping, setting up, decorating, and tearing down the store. We especially thank Myers Park United Methodist Church (site host), Myers Park Presbyterian Church, and Christ Episcopal Church for hosting this annual, highly anticipated event.9

Why should we do anything at all about the benefits cliff?

The reason is straightforward: Families can find a bridge to economic self-sufficiency. Employees experience economic security for themselves and their children when working overtime, accepting raises and promotions. Solutions like this makes them more likely to stay employed. This strategy will also help employers reduce the high-cost of employee turnover.

A coordinated and collaborative effort by government, businesses, community- and faith-based organizations, and the people themselves can create pathways to sustainable and actual reduction in poverty rates. Such efforts will increase economic stability, reduce dependency on the government, improve child and family outcomes, and support economic development for the entire community.

1 https://www.ahaprocess.com/examining-understanding-and-mitigating-the-benefits-cliff-effect/

2 https://atlantawomen.org/asset-building/

3 https://slate.com/human-interest/2018/04/just-who-is-eligible-for-child-care-assistance-is-anything-but-straight-forward.html

4 https://charlottefamilyhousing.org/two-generation-approach/

5 Ibid

6 http://www.unitedwaync.org/our-money-needs-calculator

7 https://leadingonopportunity.org/

8 https://charlottefamilyhousing.org/faith-partners/

9 Ibid